There is a plethora of business loans that are advertised with “Quick finance – apply and approved within minutes” or “You only need to have had an ABN for the past 6 months”. It can be tempting to obtain such a loan – the paperwork is simple, you often only need to provide a Director’s guarantee, and you can access funds sometimes within hours. But there’s a huge risk in taking out one of these loans – they often have exorbitant rates (over 50% APR!), are very short term with large frequent repayments (some of them take daily repayments!), are completely inflexible, and after any missed payments you are often handed over to a debt collection agency or a solicitor to initiate court action against your business. This causes immense damage to your credit rating and future ability to obtain finance.

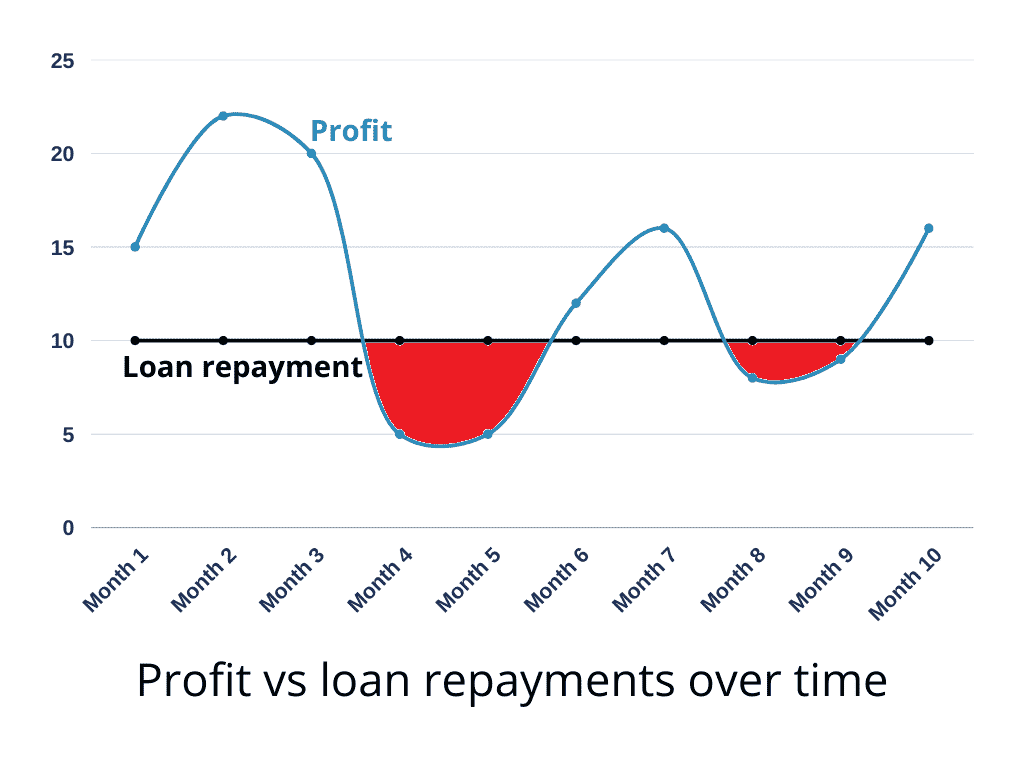

I regularly see businesses that have encountered big problems dealing with these loans. But how does a business get into trouble with these loans in the first place? Easily. Let’s take an example business and plot “profit” and “loan repayments” over a few months – the scales are irrelevant – the point to note is that the loan repayments are fixed, while business profit varies from month to month. Variability can arise due to factors such as loss of staff due to illness (Covid?), unexpected loss of contracts, supply restrictions impacting your business, even the affects of inflation reducing your purchasing power. You should know the specific risks to your business and it’s best to not be overly-optimistic by thinking “It’ll never happen to me…”.

The plot is shown below:

The periods in red are those where the business doesn’t have the funds to meet it’s committed loan repayment. In these circumstances, a business owner will look for other ways to raise funds, sometimes taking on additional fast and expensive loans from other lenders. It’s worse than “robbing Peter to pay Paul” – it’s digging a deeper and deeper debt hole from which it is increasingly harder to escape. It’s not uncommon to see businesses with three or more of these types of lenders on the their balance sheet. If the shortfall continues for a few months, the lender will refer the debt to a collections agency and/or solicitor for recovery. Any record of this on your credit file will make future borrowings more difficult, especially from Tier 1 and 2 lenders. In most cases, it’s simply not worth risking your future potential by taking out a loan facility that will hurt your business.

So what are the alternatives? Firstly, many of these types of loans do not require any form of real security (i.e. property or equipment). If you do have security to offer, then you should be able to obtain loans that are much easier to manage – lower interest rates, longer terms, and the ability to adjust repayments based on your business performance.

Secondly, many businesses don’t understand their cash conversion cycle and subsequently don’t understand that loans do not do anything to help manage cash flows (despite the fact that these loans are advertised as cash flow loans – this is misleading advertising). As a result, many of these loans are incorrectly taken as “cash flow” loans, yet the business will continue to experience cash flow problems. The only real solutions to manage cash flows are to utilise selective receivables finance and selective payables finance. Why selective? Because if you don’t have the ability to stop the financing when you don’t want or need it, you can still experience periods where your financing costs are greater than your profits (the red sections in the graph above). Also, these types of finance are like an accelerant for your business – they boost growth when you are growing and boost the decline when you’re shrinking, so you need to be able to stop these facilities in times of slow or shrinking business.

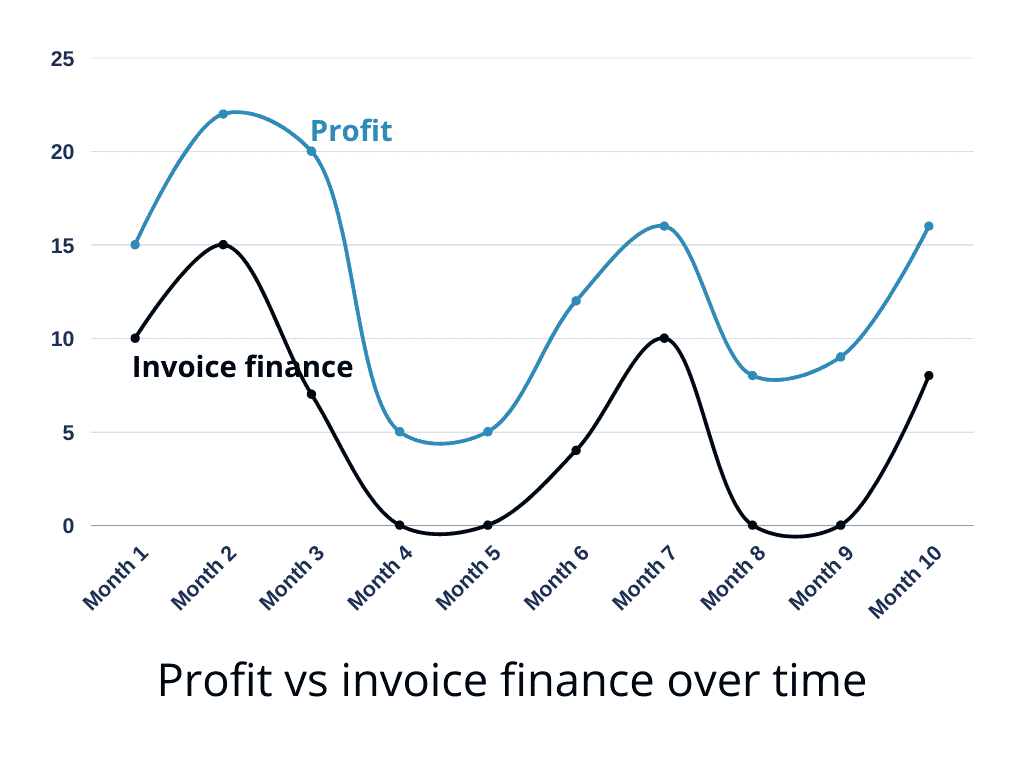

Below is the plot of our example business using selective receivables finance to fund their business growth (assuming the same downturns as before):

You can see that during less profitable months the need for receivables finance was low, sometimes zero. There is never a month where the cost of finance exceeds the profit of the business. Why? Because receivables finance is fixed to the number and size of receivables invoices your business can generate. Additionally, with selective receivables finance, you can simply “turn off” the funding when it’s not needed, and then “turn it back on” when it is needed.

Other benefits of selective receivables finance facilities are that they often don’t require any real security, and since they are not a loan, there’s no impact on your balance sheet. They may appear to be more expensive than short term unsecured loans, but this is often not the case. The cost of finance depends on each business – how and when they use the finance facilities, and the opportunity costs associated with the flexibility of each finance facility as well as the potential negative impacts when things go wrong.

In summary, the best way to ensure you obtain the right type of finance for your business is to understand what you need – do you need a cash flow solution, or a loan? What type of cash flow solution, or what type of loan? And what is the actual total cost of the facility – can you make the repayments when they are due? If you aren’t sure how to determine this, I provide plenty of resources on my website that explains these facilities and what to look for when deciding on a facility for your business. Alternatively, you can contact me at any time – I’m happy to help you as much as I can.